Everything You Need to Know About Khums

What is Khums?

Khums literally means “one-fifth.”

In Islamic terms, it refers to an obligation for Muslims (particularly in Shia jurisprudence) to pay 20% of their yearly surplus wealth, that is, one-fifth of whatever savings remain after covering all legitimate annual expenses.

This annual contribution, parallel to Zakat, is due once every lunar year and is a way to purify one’s wealth while fulfilling a religious duty.

Khums is a foundational part of the Islamic economic system, aimed at promoting justice and equity in society by redistributing excess wealth to those in need.

Paying Khums not only cleanses one’s income of impurity, it also reinforces a Muslim’s sense of responsibility to the wider community (Ummah) and to Allah (swt).

How Does Khums Work?

The obligation of Khums is established in the Holy Qur’an:

“Know that whatever thing you may come by, verily a fifth of it is for Allah and the Messenger, for the near relative, and the orphans, the needy and the traveller” (Qur’an 8:41).

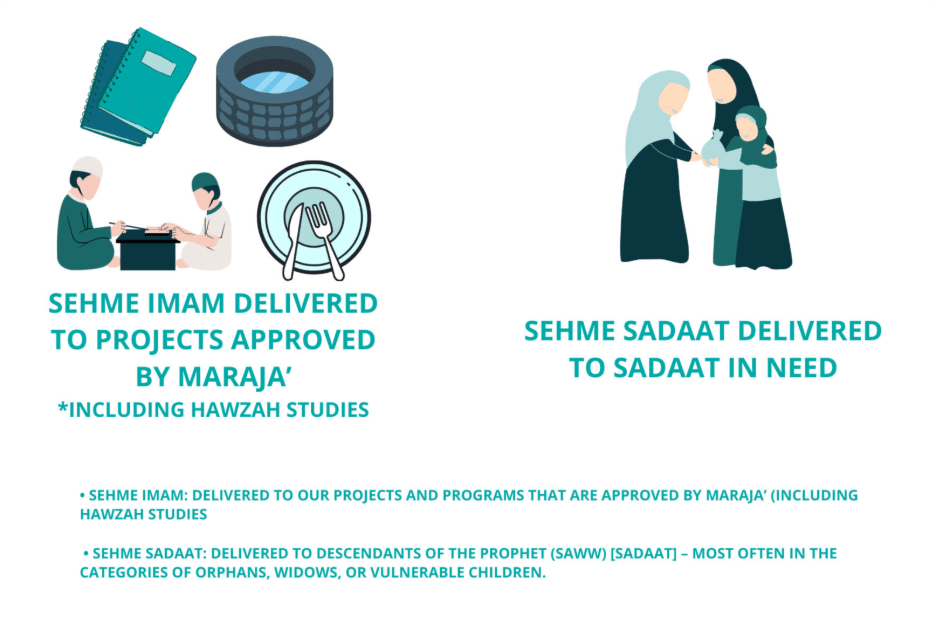

In practical terms, the total Khums amount is split into two equal parts: Sehme Imam and Sehme Sadaat.

Half of the Khums (Sehme Imam, the “Share of the Imam”) is entrusted to the Imam (ajtfs) of the time.

In our era, this share is handled by the leading religious scholars (Maraja) as representatives of the Imam (ajtfs).

They allocate these funds to causes that benefit the faith and community, such as religious education, welfare projects, and other charitable work in line with Islamic guidance.

The other half (Sehme Sadaat, the “Share of the Prophet’s Descendants”) is designated specifically for needy members of the Prophet’s family (Sadaat or Sayyids) who are facing hardship.

Notably, it is a point of Islamic consensus that Zakat (the general charity) is not given to the Prophet’s descendants, to preserve their honor.

Khums ensures that these individuals – orphans, widows, and others among Ahlulbayt (as)’s lineage who are in need – receive support with dignity.

At The Zahra Trust, we take our role in handling Khums very seriously.

The Zahra Trust has official permission (ijaza) from several leading Maraja to collect and distribute Khums funds on their behalf.

This means your Khums can be paid with confidence that it will be used appropriately and in accordance with religious guidelines and the approval of your Marja.

The Sehme Imam portion of your contribution is directed toward vital humanitarian and religious projects, for example, providing clean water, shelter, or educational support in impoverished communities as authorized by our Maraja.

The Sehme Sadaat portion is delivered directly to impoverished Sayyid families (descendants of the Prophet (saw)), such as orphans and widows, who are not eligible to receive Zakat and therefore rely on Khums assistance.

By paying Khums, Muslims help uphold social justice and strengthen humanity by sharing their excess wealth with those less fortunate.

This practice is far more than a financial transaction; it is a spiritual investment in the welfare of the Ummah.

It purifies one’s own wealth and soul while materially uplifting others.

Islam provides not only spiritual guidance, but a complete ethical and social framework, and Khums is one of its key pillars for promoting economic fairness.

On the surface, Khums may appear to be a simple yearly tax or charity, but in truth it represents an act of allegiance and trust.

Fulfilling Khums is a believer’s pledge of loyalty to the Ahlulbayt (as) and the Imam of our time (ajtfs), and a commitment to the dignity and well-being of the community.

Through your Khums, countless families are kept warm, fed, and supported as they work to overcome hardship with resilience.

In today’s world, where the gap between wealth and poverty continues to grow, Islam offers Khums as a divine system of mercy, obligation, and trust to bridge that divide.

It binds believers together with a shared responsibility for the welfare of others, especially the most vulnerable.

This isn’t just charity; it’s a system designed by Allah (swt) to uplift, empower, and preserve the Ummah.

Why Did Allah (swt) Prescribe Khums?

Unlike voluntary charity (sadaqa), Khums is an obligatory act for those who meet the criteria, it is not optional for eligible believers.

Allah (swt) ordained Khums to protect the rights of the oppressed and to ensure the dignity of the Prophet’s family is maintained.

The Prophet Muhammad (saw) famously forbade his close relatives from accepting Zakat, likening such charity for them to an impurity.

Instead, Allah allocated a share of certain wealth (like war booty, and by extension surplus income) to them through Khums.

In this way, Khums preserves honor and equity: it provides a dedicated fund to assist the descendants of the Prophet (saw) and supports religious and charitable causes for the community at large.

Khums funds preserve dignity and fairness in society, fund religious education and institutions, support orphans, widows, and the poor, and help build resilient, spiritually grounded communities.

This is justice in action: the vision of the Ahlulbayt (as) made real through our financial devotion.

Your Khums has the ability to make a very tangible difference in the lives of those in need, from providing emergency shelter to families after disasters, to supplying essential food and medicine for children in poverty.

Each contribution becomes part of a movement of unity, hope, and faith, as Muslims band together to uplift the Ummah.

How Is Khums Distributed?

As mentioned, Khums is divided into two equal portions: Sehme Imam (Share of the Imam) and Sehme Sadaat (Share of the Prophet’s Descendants).

The Sehme Imam portion is used under the guidance of the Marjaʿ (highest religious authorities) for causes that benefit the Muslim community and faith.

This can include funding Islamic education, maintaining religious institutions, aiding displaced and struggling believers, and various social welfare initiatives that have the approval of our marajʿ.

Essentially, this share is used wherever the Imam of our time would deem it most beneficial for Islam and the public good, for example, The Zahra Trust often utilizes Sehme Imam funds for programs like Water Aid, orphan support, emergency relief in countries like Afghanistan and Pakistan, and other humanitarian projects that alleviate suffering.

The Sehme Sadaat portion is given directly to Sadaat: needy and impoverished members of the Prophet (saw)’s family line.

These are often ‘sayyid’ or ‘syed’ orphans, widows, and vulnerable families who cannot receive Zakat and thus depend on Khums for support.

By channeling funds to them, Khums preserves their honor and helps eliminate poverty among the descendants of The Prophet (saw) in a dignified manner.

The Zahra Trust and Khums

The Zahra Trust is proud to be an authorized channel for your Khums in Canada.

As noted, we hold ijaza from top Shia scholars (including Ayatullah Sistani) to collect Khums, which means we are accountable for distributing these funds correctly and Islamically.

Your Khums entrusted to us will go toward providing food, water, and shelter to orphans and widows; supporting displaced families in crisis regions; funding Islamic education in under-served communities; and directly assisting Sadaat in need through Sehme Sadaat distributions.

In all cases, we ensure that your Khums is used in accordance with the guidance of your marja and for the most pressing needs of the Ummah.

Through your trust in our organization, your Khums becomes a direct source of empowerment and protection for those who are suffering.

We remain committed to this movement of justice, following the legacy of the Ahlulbayt (AS) in caring for humanity.

Our duty is to use your contributions with full transparency and impact, so that the spirit of Khums is fully realized.

Our beloved Imams (as) consistently emphasized the importance of Khums as a mechanism to establish social justice and equity.

By fulfilling this obligation, you are upholding a legacy of justice and hope for the downtrodden.

In a world where so much oppression goes unseen or unchecked, your Khums is a form of devotion, and a form of hope.

Ready to Fulfil Your Khums?

If you’re unsure about how to calculate your Khums, or whether you’re eligible, The Zahra Trust is here to help.

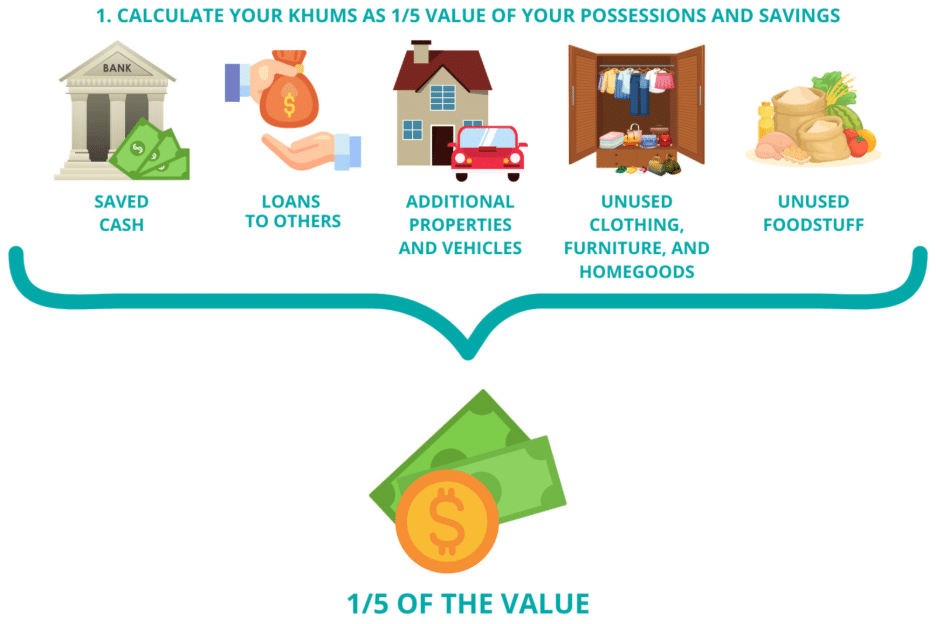

Typically, to calculate Khums you determine your net savings at the end of your financial year (after all expenses) and then take 20% of that surplus.

Our team can assist you in this calculation and guide you through any questions of religious permission (e.g. specifying your Marja in the Khums form).

You can visit our Khums information page or contact us directly for personalized help in fulfilling this sacred obligation with confidence and transparency.

With winter fast approaching, remember that your Khums could make a profound difference for those facing the bitter cold without adequate support.

Last year, thanks to the generosity of donors like you, we were able to reach 33,774 people during the winter of 2024 through Khums and charity funds.

This included providing 15,620 people with warm, nourishing food, equipping 621 people with protective winter clothing, and even installing 73 new heating systems in the homes of families struggling to stay warm.

Thank you for your support, achievements like these would not be possible without the compassion and commitment of the community.

May Allah (swt) accept your Khums, increase your sustenance (rizq), and grant you closeness to the Imam of our time (ajtfs).

FAQ

Khums is a religious obligation in Islam – especially emphasized in Shia Islam – which requires eligible believers to contribute 20% (one-fifth) of their surplus income at the end of the year towards specified causes. In practical terms, after you subtract all your living expenses for the year, if you have savings or profit remaining, one-fifth of that amount is due as Khums. It is one of the Furūʿ al-Dīn (ancillaries of the faith) in Ja’fari Shia jurisprudence, alongside duties like prayer and Zakat. The payment of Khums serves to purify one’s wealth and is a form of support for the community, as the collected funds are used for the welfare of society and for the descendants of the Prophet (saw).

Every Muslim who is ‘baligh’ (mature/adult) and financially stable enough to have savings at their year-end should assess if Khums is due.

In essence, if after a year you have surplus money or goods that are beyond your necessary expenses, then Khums becomes obligatory on that surplus.

This obligation is most prominently observed by followers of the Ahlulbayt (as) (Shia Muslims who follow the guidance of the Maraja).

Sunni Muslims generally restrict Khums to specific cases like war booty, but Shia Muslims (following the Ja’fari school) apply it to yearly savings/profits as well.

If you are unsure about your status, it’s recommended to consult your Marja or a knowledgeable scholar.

Our team at The Zahra Trust can also help determine your Khums liability if you have questions about your particular situation.

While both Khums and Zakat are forms of obligatory charity in Islam, they have different scopes and rates.

Zakat (for those required to pay it) is usually 2.5% of certain types of wealth (such as cash, gold/silver above a threshold, business goods, agricultural produce, etc.) and it has a defined list of eligible recipients (the poor, debtors, wayfarers, etc.).

Khums, on the other hand, is 20% of surplus wealth (savings/profit) after all expenses, and it is primarily mandated in Shia Islamic law.

Another key difference is in the allocation: Zakat can be given to any deserving Muslim in the eight categories mentioned in the Quran, whereas Khums is split into the two specific categories we discussed: Sehme Imam (used for community and religious causes under scholar supervision) and Sehme Sadaat (given to needy descendants of the Prophet).

In summary, Zakat and Khums are separate obligations: Zakat is smaller in percentage and narrower in scope, while Khums is a larger percentage on net income and is especially focused on supporting religious infrastructure and the Prophet’s lineage.

Some individuals may end up paying both Zakat and Khums if they meet the criteria for each, but many Shia Muslims primarily focus on Khums as it covers their surplus earnings.

The Zahra Trust is authorized by leading Shia scholars (Maraja, including His Eminence Ayatullah Sayyid Ali al-Sistani, to collect and distribute Khums funds.

We utilize Khums in strict accordance with Islamic guidelines.

The portion of Khums designated as Sehme Imam is used – with the permission of your Marja – to support community welfare and faith-based projects.

For example, Khums donations help us run programs providing food, clean water, housing, and medical aid to orphans, widows, refugees and others in crisis.

Khums funds also enable us to sponsor Islamic education and religious learning in areas that lack resources, ensuring that the teachings of Islam reach those who might not afford it.

The portion known as Sehme Sadaat is distributed directly to deserving Sadaat (needy members of the Prophet’s family) – for instance, impoverished sayyid families, orphans and widows of noble lineage – to assist with their basic needs.

By donating your Khums through The Zahra Trust, you can be confident that it is being handled responsibly and is making a tangible impact on alleviating suffering while also fulfilling the religious directives of your Marja.

These are the two components of Khums.

Sehme Imam means “the share of the Imam.”

In the absence of the Imam (during the Occultation of the 12th Imam ajtfs in Shia belief), this share is entrusted to the Maraja (high-ranking jurists) to spend in ways that would please the Imam (ajtfs).

Practically, Sehme Imam funds are used for things like supporting religious seminaries, building or maintaining mosques and community centers, funding humanitarian relief for oppressed or needy Shia communities, and other projects for the public good as identified by our scholars.

Sehme Sadaat means “the share of the Sadaat (Prophet’s descendants).” The Prophet (saw)’s family (Banu Hashim) does not receive Zakat, so Sehme Sadaat is reserved for aiding sayyids who are poor, orphaned, widowed, or otherwise in need.

This ensures that the descendants of Prophet Muhammad (saw) are cared for without having to rely on general charity, thereby upholding their honor.

At The Zahra Trust, when we receive Khums, we separate and distribute these shares under the oversight of qualified scholars: half toward authorized causes (Imam’s share) and half directly to eligible Sadaat beneficiaries.

Yes, if you have never paid Khums in previous years despite being eligible, you are still obligated to pay it for those past years.

This process is sometimes called “backdating” Khums or paying retroactive Khums.

Essentially, you would calculate, for each year missed, what your surplus income was for that year and then set aside 20% of that for Khums.

This can be a bit complex if it’s been many years or if savings from one year became the principal for the next, etc.

It’s recommended to work with a scholar or our team to calculate backdated Khums correctly.

The Zahra Trust team can assist you in determining how much you owe for past years and guide you on obtaining any necessary permissions.

Fulfilling missed Khums obligations is important to ensure that one’s wealth is purified moving forward.

Once paid, you will have “cleansed” that portion of your wealth and can start fresh with a regular annual Khums schedule.

You can fulfill your Khums obligation safely and securely through The Zahra Trust.

We have an online Khums portal to facilitate this process.

Here are the basic steps:

- Visit our Khums page: Go to https://www.zahratrust.ca/khums, where you will find detailed information and an online form.

- Complete the Khums form: The form will ask for details such as the amount you are paying, and any specific intentions or notes.

- Calculation help: If you need help calculating the exact amount, you can use our Khums calculator tool or request assistance. We can also help with obtaining any required religious permission (ijaza) if your Marja requires individual consent for Khums distribution.

- Make the payment: You can then donate the Khums amount online. We will ensure it’s allocated correctly to Sehme Imam and Sehme Sadaat. You may also contact us for other payment methods (bank transfer, etc.) if preferred.

- Receipt and allocation: The Zahra Trust will provide you with a receipt for your records. We then distribute your Khums funds to the approved projects and deserving Sadaat as described. Importantly, your Khums will be disbursed with the approval of your chosen Marja and used to support impactful, faith-driven projects that count as your share in supporting Islam and humanity.

By paying Khums through an authorized charity like The Zahra Trust, you can complete this pillar of faith with confidence that your duty is fulfilled correctly and that your contribution will reach the people and causes it is meant for. We are here to answer any further questions you might have about the process.

Donate Now

Donate Now

Donate

Donate